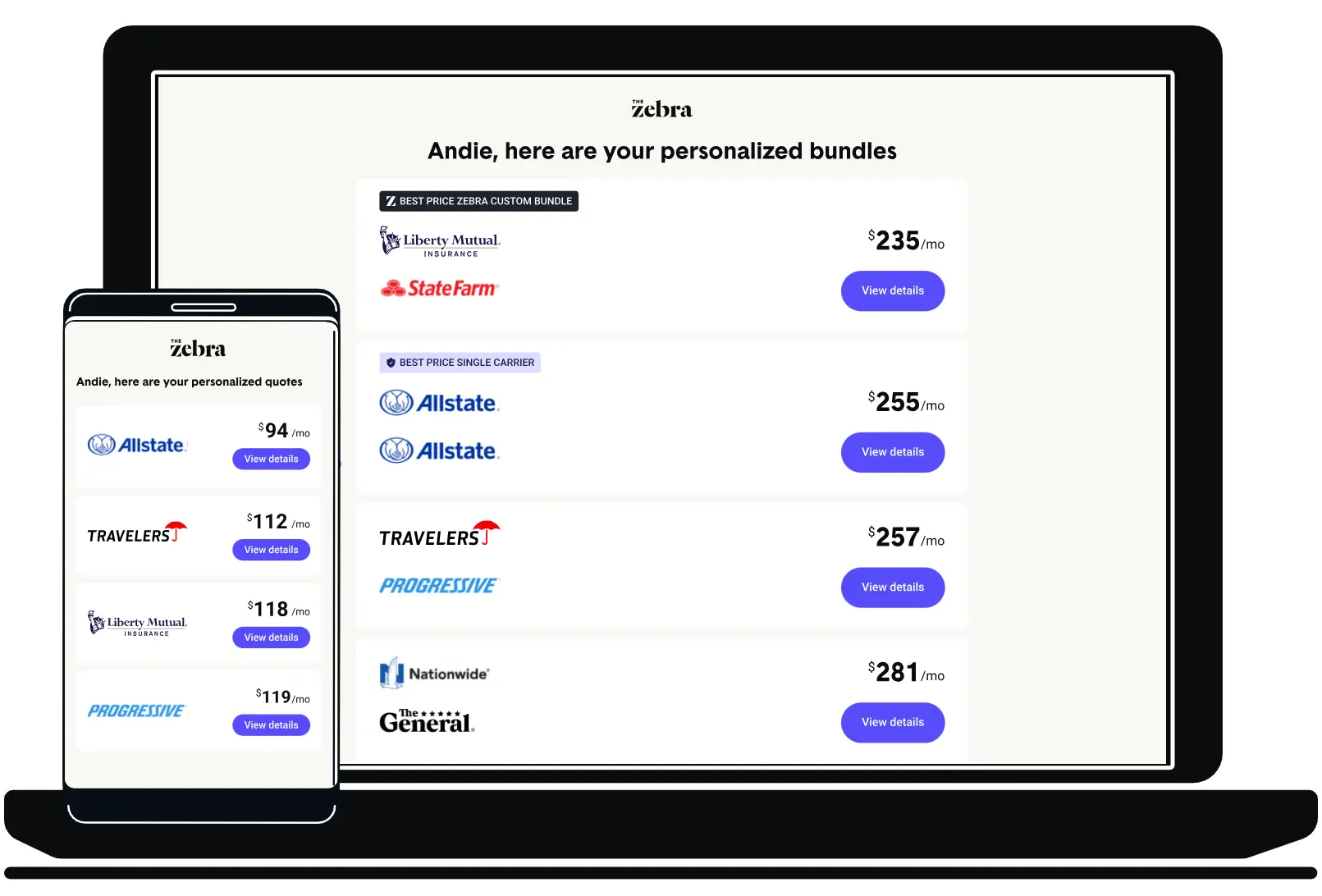

Best Cheap Car Insurance (quotes from $94/mo)

- Find cheap car insurance from companies like GEICO, Progressive, Liberty Mutual and more.

- No sales pitch. No spam calls. No junk mail.

The best cheap car insurance

The Zebra analyzed rates from top car insurance companies to see who has the cheapest rates in 2024. View the cheapest car insurance rates from some of America's most popular insurance companies below, or continue reading to see rates from more large insurance companies.

Erie's average monthly rate is $107, and the company's customer service is well-regarded.

Travelers is the second-cheapest auto insurance company, at $112 per month on average.

At just $114 per month, USAA's average rounds out top three of the industry's cheapest carriers. Note: the company's policies are only available to active-duty U.S. military, veterans and their family members.

Don't pay too much for auto insurance. Shop and save with The Zebra.

Top 10+ cheapest car insurance companies

There are hundreds of car insurance companies in the US. While you may believe it's always cheaper to go with the big brand, below you can see the cheapest car insurance options are actually from smaller companies.

| Company | Avg. Annual Premium | Avg. 6 Mo. Premium |

|---|---|---|

| Root | $669 | $335 |

| Pekin Insurance | $806 | $403 |

| Erie | $1,293 | $646 |

| Travelers | $1,342 | $671 |

| USAA | $1,365 | $683 |

| Nationwide | $1,476 | $738 |

| Metromile | $1,520 | $760 |

| GEICO | $1,542 | $771 |

| State Farm | $1,569 | $785 |

| Farmers | $1,786 | $893 |

| Progressive | $1,882 | $941 |

| Esurance | $2,062 | $1,031 |

| Allstate | $2,413 | $1,206 |

How to find the cheapest car insurance

With so many companies to choose from, the task can seem overwhelming. Through this handy guide, finding the right car insurance company at the best price is simplified. The Zebra has compiled lists of car insurance companies by price for a variety of rating factors like driving history, demographic data, and other factors.

The Zebra's guides to finding the cheapest car insurance:

If your vehicle is worth less than $4k, you might need to join the 33% of The Zebra's customers forgoing comprehensive and collision coverage.

The Zebra's quote tool compares over one hundred companies at once so you don't have to. See top companies to find the best and cheapest one for you.

If you're a low-mileage driver, consider if usage-based insurance or a telematics program would benefit you. Companies like Metromile and Mile Auto price their insurance policies by mileage. Telematics programs monitor your driving and reward you for safe driving practices.

Most insurance companies will charge your premium for at-fault accidents for 3 or more years. If possible, avoid filing a claim by paying out of pocket. If you're unsure of whether or not to file a claim, consult our claims calculator.

The Zebra’s Dynamic Insurance Rating Tool data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

Cheapest car insurance companies after an accident

It's the "golden rule" of car insurance: as a driving profile changes, so does a driver's premium. Not every company assesses accidents in the same way, so it's worth comparing insurance quotes occasionally to find the best prices.

An at-fault accident raises insurance rates by an average of 45%. The cheapest car insurance company in this situation is USAA, which still offers eligible drivers affordable rates after an accident ($144 per month). However, only members of the military community are eligible.

| Company | After At-fault Accident | Avg. Monthly Premium |

|---|---|---|

| Allstate | $290 | $201 |

| Farmers | $209 | $149 |

| GEICO | $195 | $129 |

| Nationwide | $194 | $123 |

| Progressive | $245 | $157 |

| State Farm | $167 | $131 |

| USAA | $161 | $114 |

Cheapest car insurance companies after a ticket

Car insurance rate increases may occur after a driver receives a ticket.

Included in the below insurance price analysis are violations with major insurance implications:

- DUI/DWI

- Driving with a suspended license

- Hit-and-run

- Reckless driving

Cheapest insurance companies after a DUI

A DUI can raise a driver's car insurance rates by $80 per month. Progressive is the most affordable choice after a DUI or DWI offense, while Allstate raises rates the most after a DUI citation.

| Company | Avg. Monthly Premium | After DUI |

|---|---|---|

| Allstate | $201 | $295 |

| Farmers | $149 | $213 |

| GEICO | $129 | $269 |

| Nationwide | $123 | $289 |

| Progressive | $157 | $207 |

| State Farm | $131 | $221 |

| USAA | $114 | $211 |

Progressive and Farmers assess relatively small penalties against drivers with DUIs, upping rates by less than $70 per month. Progressive's $50-per-month increase is well under the national average rate hike following a DUI conviction.

Cheapest insurers after a driving with a suspended license ticket

The average monthly rate increase after a ticket for driving with a suspended license is $75. USAA and GEICO are the cheapest companies after a citation for driving with a suspended license.

| Company | Avg. Monthly Premium | After Suspended License Ticket |

|---|---|---|

| Allstate | $201 | $273 |

| Farmers | $149 | $232 |

| GEICO | $129 | $193 |

| Nationwide | $123 | $268 |

| Progressive | $157 | $232 |

| State Farm | $131 | $205 |

| USAA | $114 | $194 |

Cheapest insurance companies after a hit-and-run

In most states, a hit-and-run incident is the most costly citation for insurance — even pricier than a DUI. Drivers ticketed for a hit-and-run should consider State Farm, a relative bargain after a citation at $218 per month.

| Company | Avg. Monthly Premium | After Hit-and-Run |

|---|---|---|

| Allstate | $201 | $293 |

| Farmers | $149 | $235 |

| GEICO | $129 | $266 |

| Nationwide | $123 | $255 |

| Progressive | $157 | $238 |

| State Farm | $131 | $218 |

| USAA | $114 | $214 |

Cheapest insurance companies after reckless driving

The definition of reckless driving varies by state, but regardless of location, it comes with a hefty insurance penalty. On average, a reckless driving charge raises insurance rates by around $75 per month.

If you don't qualify for USAA, State Farm is the second-cheapest insurer after a reckless driving citation, at $215 per month.

| Company | Avg. Monthly Premium | After Reckless Driving Ticket |

|---|---|---|

| Allstate | $201 | $284 |

| Farmers | $149 | $234 |

| GEICO | $129 | $227 |

| Nationwide | $123 | $259 |

| Progressive | $157 | $227 |

| State Farm | $131 | $215 |

| USAA | $114 | $163 |

No sales pitch. No number phone. No junk mail. No hidden fees.

Cheapest auto insurance companies for teen drivers

If a parent's greatest fear is their child getting behind the wheel, covering their car insurance premiums might be a close second. On average, teen drivers pay 83% more for insurance than older drivers do. USAA is the cheapest company for teen drivers, with Nationwide the best option for drivers who don't qualify for USAA coverage.

See below the average monthly premiums from popular car insurance companies with a teen driver added to the car insurance policy of a married couple.

Teen drivers and insurance: more data

Consult our in-depth guides for age-specific data and company-by-company breakdowns:

- Cheap car insurance for young adults

- Car insurance for 16-year-olds

- Car insurance for 17-year-olds

- Car insurance for 18-year-olds

- Car insurance for 19-year-olds

- Car insurance for families

| Insurance company | Avg. Monthly Premium | Avg. Monthly Premium (with teen driver) |

|---|---|---|

| Allstate | $168 | $273 |

| Farmers | $143 | $242 |

| GEICO | $102 | $211 |

| Liberty Mutual | $137 | $211 |

| Nationwide | $106 | $177 |

| Progressive | $107 | $237 |

| State Farm | $112 | $203 |

| USAA | $94 | $137 |

Cheapest insurance companies for drivers with bad credit and good credit

In most U.S. states, insurance companies take into consideration a driver's credit score when setting rates. An improvement of one credit tier leads to savings of an average of about $32 per month.

Drivers with bad credit should consider Nationwide and GEICO. This is especially important considering insurance for drivers with bad credit is $125 more expensive per month than it is for drivers with excellent credit.

The use of credit scores in setting insurance rates is controversial, and some lawmakers are working to curtail it. In fact, several U.S. states already prohibit the practice.

| Company | Yearly Average - Excellent | Yearly Average - Poor |

|---|---|---|

| Allstate | $2,160 | $3,434 |

| Farmers | $1,525 | $2,724 |

| GEICO | $1,397 | $2,174 |

| Nationwide | $1,331 | $1,984 |

| Progressive | $1,461 | $3,716 |

| State Farm | $1,224 | $4,126 |

| USAA | $1,216 | $2,393 |

Enter your information once. Get dozens of possible policies.

How to get cheap car insurance: discounts and tips

If you're looking for affordable insurance, the best place to start is online. Your best bet is to gather quotes from multiple companies to see which offers the best coverage at the best rate. It's also a good idea to look into discount opportunities, as most car insurance companies may apply discounts for qualifying drivers. If you aren't sure where to start, read on for tips or speak to a licensed agent to understand your options.

Remember: your car insurance rate is specific to you

Many factors determine car insurance rates, including location, your age, insurance history, driving history and the make and model of your vehicle.

If you've accumulated at-fault accidents or claims, your rate will increase. If your credit score is low or your ZIP code has a large number of uninsured motorists, you might not be able to find cheap auto insurance.

Auto insurance discounts

You can’t improve your credit score overnight, but there are some easy ways to reduce the cost of insurance — like car insurance discounts.

Multi-policy/bundling auto insurance discount

Qualifying for this discount involves carrying two insurance policies with one company. Common bundling combinations include a home-and-auto bundle or a renters-and-auto bundle. A homeowners-auto combo saves an average of $12 per month, compared to $6 for a renters-auto pairing.

Safe driving discount

This discount entails taking a defensive driving course and presenting your insurance company with proof — like a receipt or transcript. The logic behind this discount is clear: a safer driver is a cheaper client because they're less likely to file a claim. Consult our guide to auto insurance for good drivers to learn more about how to save.

Equipment discount

If your car comes with an anti-theft device or a service like LoJack, your insurance company may provide a discount. The discounts tend to be smaller than a multi-policy or defensive driver discount. In our survey, we found systems such as night vision devices, park-assist devices and rearview cameras did not earn discounts.

| Safety/Anti-Theft Device | Average Annual Premium | Discount |

|---|---|---|

| None | $1,483 | — |

| Blind Spot Warning Device | $1,481 | $2 |

| Collision Preparation System | $1,482 | $1 |

| Electronic Stability Control (ESC) | $1,474 | $9 |

Good driver discount

This discount is available to drivers with clean driving records. Good driver discounts can be added when your Motor Vehicle Report (MVR) or CLUE report is pulled at the inception of your auto policy. If you're convinced your record is clean (no at-fault accidents or violations) and you aren't receiving a discount, speak with your insurance company and inquire about a discount. By keeping a clean slate, you can earn a discount of approximately 10%.

Military discount

Many companies offer discounts for active or former military members and their families. The amount and qualifications differ per company but you should ask if your current company has this discount.

Multi-car discount

A multi-car discount involves insuring more than one car with a single insurance company. Typically, the discount is automatically added either at policy inception — if two cars were originally added — or when you add the second vehicle to the policy.

Preferred payment discount

This discount refers to the manner in which you make your insurance payments and has tiers, typically. For example, if you pay your entire premium upfront, you are often given a discount: the highest preferred payment discount. A paid-in-full discount can save you $73 per year on your auto policy.

If you set up automatic payments from a bank account, you can often receive an Electronic Funds Transfer (EFT) discount. An EFT discount can lead to savings of about $21 annually. If you are able to pay up front or through automatic payments, this is a great way to get cheaper car insurance.

Occupation discount

Some insurance companies will offer a discount based on your occupation. Statistically, some occupations — teachers, physicians or police officers — are less likely to file a claim and thus pose less risk. Because of this, some insurance companies return the savings back to you. Usually, they will require proof of your profession, such as a photocopy of your professional degree or certification.

For more information on cheap car insurance and profession-based discounts, see our guides:

Good student discount

If you're responsible for insuring a young driver, you understand how expensive this can be. Given the number of claims they cause, teen drivers are considerable risks for insurance companies. If your son or daughter has the grades — typically a GPA of 3.0 or better — speak with your insurance company about a good student discount. Normally, they’ll ask for a transcript every policy period as proof.

Save an average of $440 a year by comparing your options.

Cheap car insurance near you: comparing rates by state

Because each driver, location and situation differs, it's hard to say which insurance company has the cheapest rates.

To find out which company offers the best cheap car insurance for you, compare auto insurance options every six months from multiple insurance companies.

Find cheap car insurance by state:

Related Questions

Got a question about cheap car insurance? We're here to help!

Will having historical plates on my car lower the cost of insurance?

It is illegal to pay for someone else's car insurance

Why is car insurance so expensive in Kentucky?

Does it cost more to insure a turbo engine vehicle than a non-engine car?

Related content

- Best Car Insurance for a Learner's Permit

- Car Insurance Rates by City

- Car Insurance Without a Social Security Number

- Car Insurance Without a VIN

- Can You Get Car Insurance without an Address?

- Car Insurance with an Open Claim

- Why is Car Insurance so Expensive?

- Best Time to Shop for Car Insurance Quotes

- Are Car Insurance Rates Negotiable?

- When Do Car Insurance Rates Go Down?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.