Cheap Car Insurance for 17-Year-Olds

Why is auto insurance so expensive for 17-year-olds?

For a car insurance company, insuring a 17-year-old driver is a relatively risky undertaking. Statistically speaking, 17-year-olds are more likely to engage in dangerous driving practices, leading insurance companies to see insuring a 17-year-old driver as a risky investment. Car insurance companies protect their interests from this risk through higher premiums, resulting in higher costs for the consumer. As a result of this, the average 17-year-old in 2019 paid an annual premium of $5,429 for car insurance — far more than the national average of $1,548.

In addition, the age of the young driver, the car insurance company you choose, your gender, your location, and the type of car you drive each contribute to the cost of car insurance. To break down the cost of car insurance for 17-year-olds and the best ways to save (such as by gathering quotes), we examined an array of pricing factors.

Insurance rates for 17-year-old drivers: by company

In an experiment to determine which car insurance company was the cheapest for teens, we discovered that Geico provided the lowest premium with all other metrics constant with Progressive coming in second. Our profile was a 17-year-old added to their parent's policy across 5 zip codes in the US. If you don't fall into our specific profile or into the zip codes we surveyed (which is highly likely), use our findings as a starting point while looking at many different companies to find the best rate for you and your driver. Because your teen's rate changes so much as they age, we suggest shopping for car insurance every six months.

| Company | Avg. Annual Premium |

|---|---|

| USAA | $3,973 |

| GEICO | $4,361 |

| Nationwide | $5,125 |

| State Farm | $5,323 |

| Farmers | $7,435 |

| Allstate | $7,737 |

| Progressive | $8,250 |

The Zebra’s Dynamic Insurance Rating Tool data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

Age and car insurance premiums

Regardless of the car insurance company you chose, the big reason why you're going to be paying higher rates for your 17-year-old's premium is simply because of their age. Out of every age group, drivers between 16-19 pay the most for car insurance. Rest assured, however, you begin to see some savings once your driver turns 19 and again when they turn 21 and 25. This data is the average rate for an annual policy for a 17-year-old added to a family plan in which the parents are both 50-year-olds driving a 2012 Honda Accord and a 2012 Ford Escape.

Gender and car insurance premiums

As a driver grows older, gender becomes a less important contributing factor to their premiums. But while a driver is young, age remains an impactful rating factor.

For example, young male drivers are seen as the highest-risk auto insurance customers due to the likelihood of their taking risks behind the wheel. In the estimation of auto insurance companies, more risk equates to more claims payouts. On average, 17-year-old males cost $320 more to insure per six-month policy period than a young female driver. But don't lose hope: as you age, the insurability difference between men and women becomes less significant. Some states don't allow insurers to use gender as a metric for determining car insurance premiums.

| Gender | Age | Avg. Annual Premium |

|---|---|---|

| Female | 16 | $5,969 |

| Male | 16 | $6,701 |

| Female | 17 | $5,014 |

| Male | 17 | $5,634 |

| Male | 18 | $5,064 |

| Female | 18 | $4,483 |

| Male | 19 | $3,963 |

| Female | 19 | $3,486 |

Stay in touch and subscribe!

Get advice, insights and tips from our newsletter.

Location and auto insurance premiums

Because auto insurance is ZIP-code-specific and state-regulated, it will vary based on where you and your young driver live. Generally, most states require drivers to maintain mandatory minimum liability coverage, but these limits vary. Some states require higher limits and mandatory additional coverage that other states do not. Michigan, for example, is a No-Fault state and requires drivers to carry an unlimited amount of Personal Injury Protection which increases the costs of car insurance premiums significantly.

Furthermore, the number of people in your state can also impact your child’s car insurance rate. States with a low population density, such as Midwestern states like Ohio, tend to have lower premiums than states with more people such as New York. Keeping with the idea of risk management, the more drivers your state has, the more likely you are to be in an accident. Moreover, if you live in a coastal area that is susceptible to hurricanes (Florida and Louisiana), you can definitely expect this to impact your car insurance premium. All of which means your car insurance company will protect itself through higher premiums.

How to save on car insurance as a 17-year-old

Now that we’ve discussed the expense of insuring a 17-year-old, let’s talk about ways to save.

Defensive driver discount

Taking a professional driving course that focuses on highway safety and how to be a smart and defensive driver is another way to save some extra money on you or your teen's car insurance premium. While it is a pretty common discount, your car insurance company will usually require proof of this such as a receipt. Not every car insurance company offers this discount, so ask your insurance company beforehand!

Good student discount

Maintaining a grade point average of 3.0 or above can save you quite a lot on car insurance. Like the defensive driver discount, your car insurance company still requires proof every policy period (6 to 12 months depending on your policy) that you or your student meets the requirements. A transcript usually serves as enough proof for the discount to be added.

| Age | Male | Female |

|---|---|---|

| 16 | $439 | $248 |

| 17 | $348 | $222 |

| 18 | $338 | $197 |

| 19 | $278 | $160 |

Keep young drivers on the family policy

Unless your 17-year-old has a high-paying job and can afford to pay nearly $6,000 or premium per year for car insurance, it could be cheaper to keep them on your policy. On average, it costs $57 more per six-month policy period for a 17-year-old to be on their own policy than to be on the family plan. While that $57 doesn't seem like a lot of money, you should be aware that most car insurance companies require anyone who is living in your household and is above legal driving age to be either added as a covered driver or removed entirely.

Keep a clean driving record

Keeping a clean driving record for your son or daughter is an absolute necessity. Distracted driving, reckless driving, or being in an at-fault accident can cause serious damage to your car insurance premium at an already expensive time. In a state-by-state breakdown, DUIs and racing (seen on average the most expensive citations) raise insurance premiums at least 40%. Moreover, most car insurance companies offer a safe driver discount which is dependent upon a clean driving record.

Be smart with your car insurance claims

While this suggestion isn’t age-specific, a young driver’s propensity to cause damage to your vehicle and the monetary implications of that make it extra relevant. “Being smart with your claims” basically means don’t use your collision coverage unless you total your vehicle. Whether you know it or not, using your collision coverage is often seen as an at-fault accident to an insurance company. Now, most insurance companies will rate (i.e., charge) you for an at-fault accident for 3 years. Here’s a handy chart to see how one claim can affect your premium over these three years.

| Increase at 6 months | Increase at 12 months | Increase at 3 Years |

|---|---|---|

| +$291 | +$582 | +$1,746 |

When considering filing a claim, follow this checklist:

- Get an estimate for the repairs first. This can be done at a local mechanic shop

- Use our State of Insurance analysis to see what the percentage increase for an at-fault accident is for your state

- Compare the three-year increase (plus your collision deductible) to the value of the out-of-pocket repairs. Whatever the cheapest option is, do that.

Be smart with your coverage

Again, this coverage isn’t exactly age-specific but is helpful. Unlike your home or fine wine, a vehicle actually loses value over time. So, if you’re giving your young driver an older vehicle to drive (which is a good idea), the coverage it once had might not be necessary anymore. Another good rule of thumb in the car insurance world is if a vehicle is worth less than $4,000, you probably don’t need physical protection. Cutting physical protection, otherwise known as comprehensive and collision coverage, can half your premium!

| Coverage | Avg. Annual Premium |

|---|---|

| Liability only | $597 |

| Full coverage w/$1,000 deductible | $1,554 |

| Full coverage w/$500 deductible | $1,760 |

Shop around

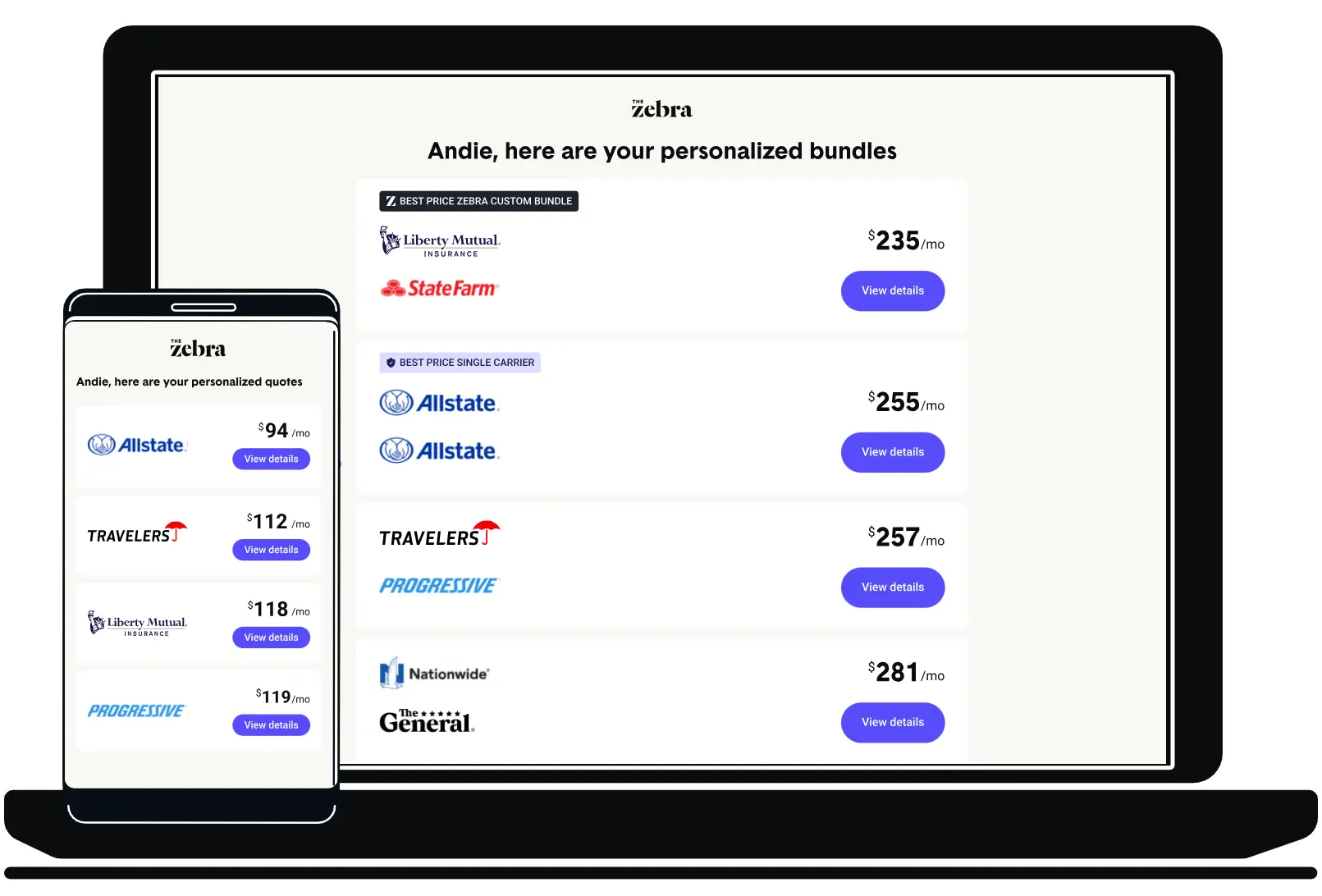

As you can see, there are many factors that go into your child's car insurance premium. Because of this, it's important to shop around for car insurance with as many different companies as possible every 6 months to make sure you're getting the best rate. Only with The Zebra can you see hundreds of different premiums at once.

Summary: car insurance for 17-year-olds

The moral of the story is simple: car insurance at 17 is going to be expensive. Young drivers represent major red flags to car insurance companies. In your search for cheap car insurance, you should use the insurance company data we presented as a starting point, starting, but not ending, with Geico and Progressive. Next, consider discounts and be mindful of your coverage and claims.

Comparing free insurance quotes is a great way to get the best coverage at a price you can afford.

Compare insurance rates quickly and easily.

Related content

- Cheap Car Insurance for 30-Year-Olds

- Cheap Car Insurance for 20-Year-Olds

- Cheap Car Insurance for 60-Year-Olds

- Cheap Car Insurance for 23-Year-Olds

- Cheap Car Insurance for 21-Year-Olds

- Cheap Car Insurance for 19-Year-Olds

- Cheap Car Insurance for 50-Year-Olds

- Cheap Car Insurance for Young Adults

- Cheap Car Insurance for 22-Year-Olds

- Cheap Car Insurance for 40-Year-Olds

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.