Car Insurance for New vs. Used Vehicles

Use The Zebra to get car insurance for new and used vehicles from GEICO, Progressive, Nationwide, Liberty Mutual and Allstate (+100 other companies)

Insurance for a new car vs. used car

If you’re deciding between a new and used car, the price may be one of your primary considerations. As part of that assessment, it's worth considering the vehicle list prices and the cost to maintain and insure the cars.

Because car insurance is so specific, it’s impossible to give a blanket statement regarding which is cheaper to insure. Your insurance rate depends on your driving history, vehicle, coverage level and your insurance company. See below data comparing insurance costs for new and used vehicles.

Which is cheaper for insurance: a used car or a new car?

While the list price of a new vehicle is usually more expensive than that of a used car, that isn't always the case for insurance. The value of any vehicle will depreciate as the vehicle ages, but sometimes things like state-of-the-art safety features, more easily replaceable parts, and other factors can contribute to making a newer vehicle cheaper to insure. Still, insurance companies base the replacement cost of new vehicles vehicle on the factory price, not what you paid for it. This could contribute to higher rates.

The inverse of depreciation occurs when an automobile is deemed as collectible by the specialty automotive community. The more exotic or rare, the higher the replacement costs and insurance premiums.

To provide a starting point in your search, we gathered insurance data comparing a 2013 Honda Accord with a 2019 Honda Accord (methodology here). The used car was $18 cheaper per month to insure than the new model.

| Company | New vehicle - monthly premium | Used vehicle - monthly premium |

|---|---|---|

| Allstate | $202 | $154 |

| Farmers | $155 | $158 |

| GEICO | $116 | $103 |

| Liberty Mutual | $151 | $142 |

| Nationwide | $111 | $100 |

| Progressive | $155 | $129 |

| State Farm | $120 | $109 |

| USAA | $118 | $87 |

| Average | $141 | $123 |

If you’re set on buying a new vehicle, keep in mind potential premium differences by company. Based on our research, Nationwide and USAA offer the cheapest rates for new car insurance.

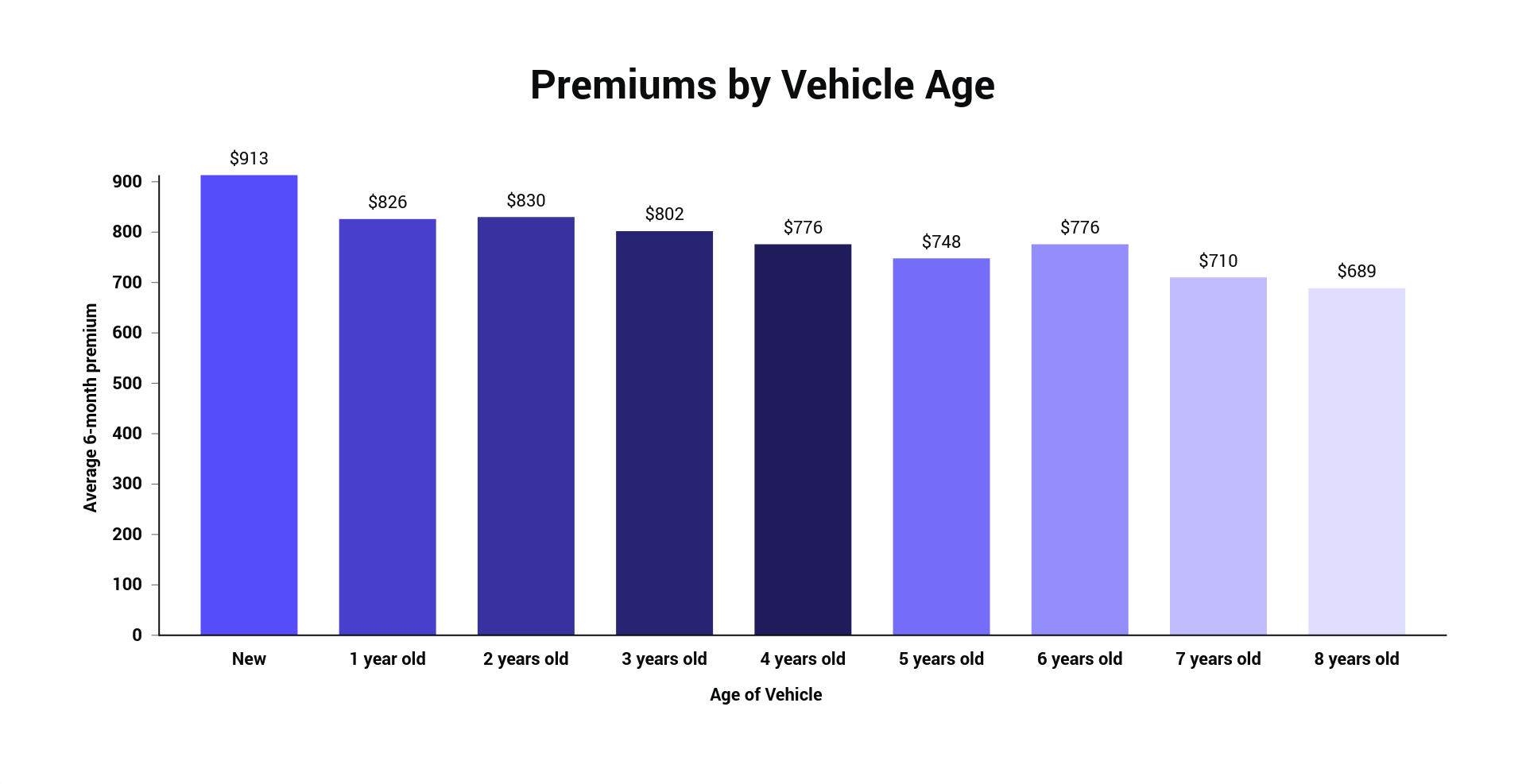

Auto insurance rates drop by 3.4% for every year your vehicle ages. An eight-year-old vehicle is approximately 25% cheaper to insure than is a brand new vehicle. For example, a brand new Honda Accord could cost $74 more per month to insure than an eight-year-old Honda Accord.

Find the right policy in only a few minutes.

How do car insurance requirements differ for a new vehicle versus a used car?

Vehicles may require different coverage levels — and different levels of expense.

If you acquire a new car via a loan or lease, you'll probably be required to carry additional coverage not mandated for a used vehicle. This includes minimum levels of collision and comprehensive coverage, as well as gap insurance.

These coverage options provide physical protection for your vehicle in the event of an at-fault accident.

Although most states require liability insurance, comprehensive and collision coverages are only mandatory if specifically stated in your lease or loan agreement. If your vehicle is worth more than $4,000, comprehensive and collision are recommended.

Both of these types of coverage options are specific to new vehicles. They both work to cover you if your vehicle is totaled and the payout you receive from your insurance company doesn't cover the original loan of the vehicle. Let’s say you obtained a $20,000 loan for a vehicle that was totaled six months later.

Because vehicles tend to depreciate rapidly, you might only receive $17,000 from your insurance company, leaving you on the hook for the $3,000 difference. Gap insurance or lease/loan payoff would help cover the difference.

The best car insurance companies for used vehicles

If you do opt to purchase a used vehicle, it's worth doing some research to ensure you find affordable auto insurance coverage. The Zebra's insurance experts surveyed rates from some of America's most popular companies for the most common used cars from model years 2014, 2017 and 2018.

While these vehicles and driving profiles won’t match yours to a T, the data should function as a jumping-off point in the search for cheap car insurance.

| Company | 2014 | 2017 | 2018 |

|---|---|---|---|

| Allstate | $925 | $1,053 | $1,104 |

| Farmers | $765 | $836 | $871 |

| GEICO | $629 | $720 | $851 |

| Liberty Mutual | $806 | $872 | $897 |

| Nationwide | $582 | $590 | $586 |

| Progressive | $775 | $795 | $594 |

| State Farm | $665 | $709 | $744 |

| USAA | $486 | $534 | $533 |

| Company | 2014 | 2017 | 2018 |

|---|---|---|---|

| Allstate | $961 | $1,074 | $1,115 |

| Farmers | $925 | $1,034 | $1,067 |

| GEICO | $702 | $796 | $953 |

| Liberty Mutual | $851 | $910 | $943 |

| Nationwide | $754 | $734 | $720 |

| Progressive | $728 | $761 | $771 |

| State Farm | $691 | $758 | $777 |

| USAA | $494 | $536 | $537 |

| Company | 2014 | 2017 | 2018 |

|---|---|---|---|

| Allstate | $928 | $1,060 | $1,085 |

| Farmers | $811 | $860 | $874 |

| GEICO | $697 | $735 | $749 |

| Liberty Mutual | $819 | $862 | $893 |

| Nationwide | $680 | $679 | $667 |

| Progressive | $763 | $802 | $813 |

| State Farm | $680 | $705 | $720 |

| USAA | $496 | $537 | $566 |

| Company | 2014 | 2017 | 2018 |

|---|---|---|---|

| Allstate | $953 | $1,065 | $1,111 |

| Farmers | $802 | $883 | $908 |

| GEICO | $703 | $812 | $836 |

| Liberty Mutual | $800 | $867 | $871 |

| Nationwide | $727 | $730 | $717 |

| Progressive | $720 | $750 | $759 |

| State Farm | $674 | $718 | $735 |

| USAA | $485 | $511 | $499 |

Based on The Zebra's survey, USAA was the cheapest car insurance company for popular used vehicles. If you don't qualify for coverage through USAA, Nationwide is another affordable option for used car insurance.

The 2014 Honda Accord was the cheapest used car to insure, with average rates of $704 for a six-month premium ($117 per month). Remember, these data points are averages and may not match your situation. View our methodology.

How to get car insurance for a used vehicle

If a vehicle passes inspection and everything seems in order, the next step is purchasing an auto insurance policy for your used car. If you buy your car from a dealership, the dealer will most likely require proof of insurance prior to your driving the vehicle off the lot. If this is the case, you'll want all the information necessary to get insured as soon as possible in order to get same-day auto insurance.

Here’s what you will need to get auto insurance:

- Dates of birth of drivers using the vehicle

- Driver’s license numbers of drivers using the vehicle

- Garaging address of the vehicle (most likely your home address)

- Insurance history of drivers using the vehicle

- Driving record of drivers using the vehicle

- Vehicle Identification Number (VIN), which will provide the vehicle’s vital information, including make/model

Your VIN is especially important for used vehicle insurance, as it shows the vehicle’s entire history. If the vehicle has been previously totaled and salvaged, this would show up via the VIN. This is another important reason to get your used vehicle inspected prior to purchase. Some auto insurance companies will deny coverage if a vehicle has been salvaged, based on the risk presented by an overhauled vehicle.

Should I get car insurance before buying a used car?

Once you find the vehicle you want, you can get a used car insurance quote before purchasing the vehicle by using the VIN. Dealerships often list the VIN on their websites, providing an accurate estimate of your car insurance quote. Most insurance companies will then supply a quote number, which you can use to retrieve the saved quote.

Once you activate the policy, your new insurance company will send the proof of insurance to the dealer and you, and you’ll be able to drive off the lot.

Factors that insurers use to calculate your auto insurance rate include your age, location, credit score, driving history, marital status, and more. Maintaining a good credit score and a clean driving record free of DUIs, hit-and-runs, and other violations goes a long way toward earning lower insurance rates.

Used car buying tips

Although buyers often overlook this step, it is vital to get a used car inspection before purchasing the vehicle. Most dealers and private sellers will allow you to take the car for an inspection or host a mobile session at their home or dealership. If they don’t allow you to do this, consider it a warning sign, i.e., there’s something the seller doesn't want you to know.

In addition to getting an inspection, consider requesting a Carfax report. Using the VIN, a Carfax report can tell you the accident report of the vehicle as well as other important information. Be especially careful if buying a preowned car in the months following a natural disaster. Dishonest sellers may use quick cosmetic fixes to hide severe damage sustained via floods or wildfires.

New vs. used car insurance: how to choose the right vehicle

Ultimately, the decision between new and used comes down to personal preference. Research what insurance costs to expect from your vehicle, and consider the vehicle's sticker price. If you’re stuck deciding between a handful of vehicles, use The Zebra to get personalized car insurance quotes for each vehicle.

Decide which car insurance policy is right for you.

Related Content

RECENT QUESTIONS

Other people are also asking...

If my car is determined a total loss in an accident, will my gap insurance cover my down payment?

Can I sell my used car to someone with no insurance?

I just bought a used car and it is still insured under the previous owner. Am I covered?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.