Low-Income Car Insurance

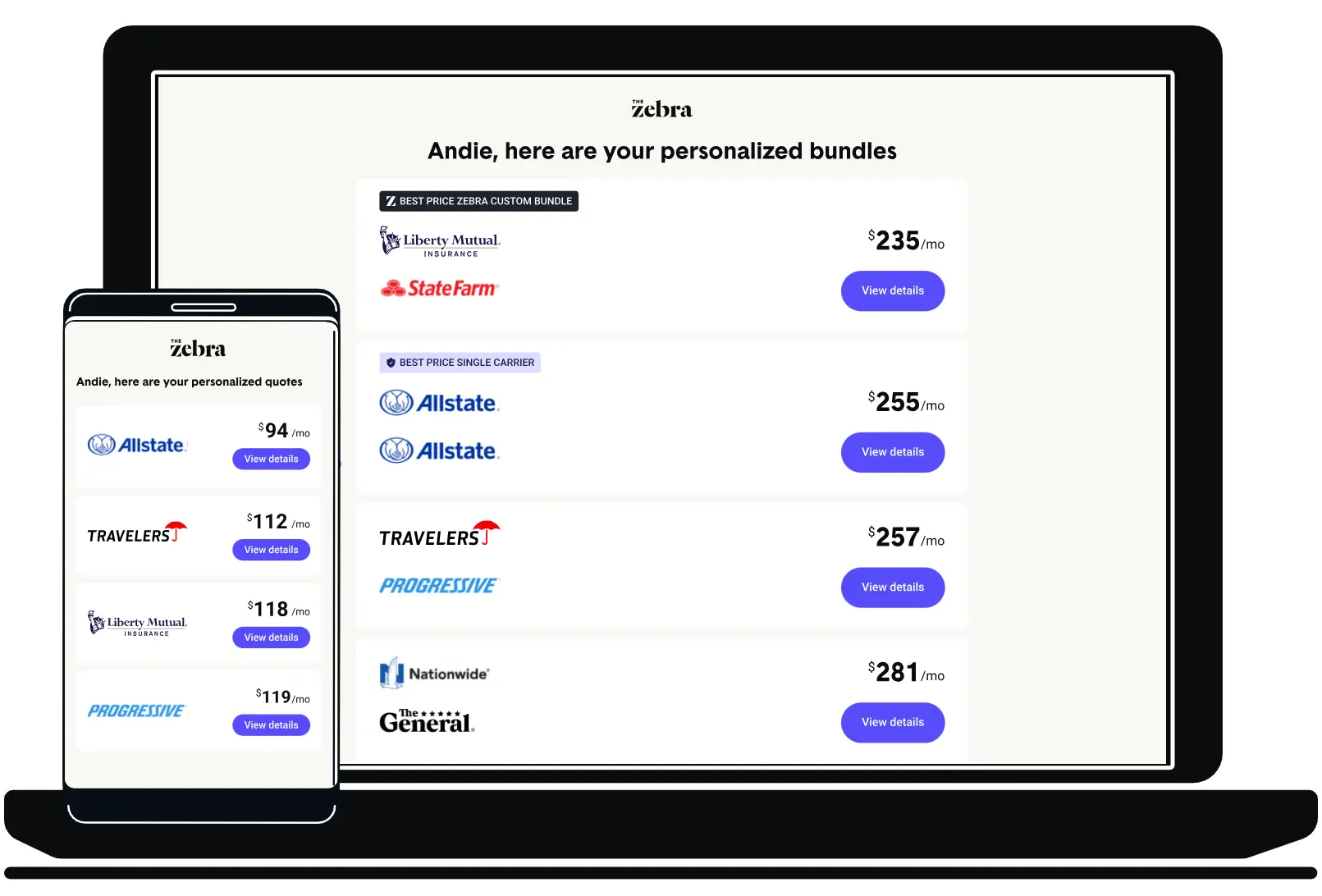

Have a tight budget? Use The Zebra to compare quotes from 100+ companies. Or, scroll down to learn how to find low-income car insurance in your state and other savings tips.

Car insurance for low-income drivers: everything you need to know

Income doesn't directly impact car insurance rates, but factors correlated with income, such as credit score, education, homeownership, and ZIP code, in most states do influence your premium. Yet, our data shows those earning between $10,000 and $19,000 per year pay nearly as much as those earning above $200,000.

Given the surge in vehicle-related costs and inflation, it's not hard to understand why people are looking for car insurance they can afford on a low income. Let's discuss how.

Key takeaways:

- Income is not a factor in your car insurance rates

- Some states offer assistance programs, so it's worth checking with your state's insurance department to see if you qualify

- Comparison shopping for car insurance is crucial for low-income individuals to find the best rates

- Increasing deductibles and reducing coverage on older or less valuable vehicles can help reduce the cost of car insurance for low-income individuals

How to find low-income car insurance by state

A report by the Consumer Federation of America cited that most uninsured drivers in the United States are considered low-income, and are often negatively impacted by actions like raising minimum liability requirements and stiffer penalties[1]. So, if you’re on a tight budget, finding cheap car insurance is important to staying insured. Some states offer assistance programs for low income drivers to obtain car insurance protection — let's start here.

California

California has a program called California’s Low-Cost Automobile Insurance Program, or CLCA, and is designed to provide low-cost insurance rates for eligible drivers[2].

What are the requirements for CLCA eligibility?

- Combined household income, based on the number of people:

- 1 = $30,150

- 2 = $40,600

- 3 = $51,050

- 4 = $60,500

- A good driving record

- No at-fault accidents in the past three years

- Must be at least 19 years old

- Must own a valid driver’s license

- Must own a vehicle that is valued at less than $25,000

- And, naturally, a California resident

If you meet the above qualifications and decide to opt to participate in CLCA, your insurance limits for bodily injury liability and property damage liability would actually be lower than the state limits. As participants in this program are exempt from state requirements, your limits would be $10,000 for bodily injury or death per person, $20,000 total for bodily injury or death, and $3,000 total for property damage. The amount of the premium ranges based on your insurance history and your county.

Hawaii's AABD program eligibility

- You are blind

- You have suffered from a physical or mental disability for at least 12 months which causes you to be unable to work

- You live with and take care of someone who receives AABD benefits

- You have a terminal condition that prevents you from working

- Your Social Security or Supplemental Security Income doesn’t provide you with enough money

How to get coverage under Hawaii's AABD program:

Because this is a government program, you would need to speak with the Hawaiian Department of Human Services in order to receive any benefits from AABD.

New Jersey

New Jersey’s plan, Special Automobile Insurance Policy (SAIP), provides only the medical coverage portion of your auto insurance after a car accident[4]. Eligibility is dependent upon you already being qualified for federal Medicaid with hospitalization, which an insurance agent can determine from your Medicaid ID card.

How much does SAIP cost and what are the requirements?

SAIP costs $365 per year. This coverage is also contingent upon the annual renewal of your Medicaid benefits. For example, if your Medicaid benefits were to lapse mid-year, your SAIP benefits would continue until the next renewal.

What does SAIP cover?

This coverage pays for emergency medical treatment immediately following an accident, including the treatment of serious brain and spinal injuries up at $250,000. In the event of death, a $10,000 benefit is available.

What doesn’t SAIP cover?

As stated, this policy is for medical coverage only — so things like comprehensive or collision coverage aren't provided.

New Jersey and Pennsylvania

CURE, or Citizens United Reciprocal Exchange, advertises itself as an insurance provider in New Jersey and Pennsylvania that only uses your driving record as a factor for your rate[5]. It works similarly to other insurance providers in terms of coverage options, discounts and payment plans.

Maryland

The Maryland Automobile Insurance Fund is a government-created program in the state of Maryland specifically designed to provide liability insurance for residents who are unable to receive auto insurance on the open market[6]. Independent from the actual state government, they cater to people who have been denied coverage because of poor or no credit, lapses in insurance or a poor driving record.

Compare quotes from over 100 providers.

Best car insurance companies for low-income drivers

If you don't live in a state with an assistance program or you don't qualify, your next step should be comparing rates from several car insurance companies. Insurance companies assess your driving profile and their own loss/revenue ratio in order to profile a premium. This means that your rate with one company isn't the same for all companies. Below are some average rates based on an average driver profile in our methodology. As you can see, rates vary substantially depending on which carrier you choose.

| Company | Avg. 6 Mo. Premium | Avg. Monthly Premium |

|---|---|---|

| Allstate | $1,283 | $214 |

| Farmers | $963 | $161 |

| Progressive | $955 | $159 |

| State Farm | $874 | $146 |

| Nationwide | $833 | $139 |

| GEICO | $832 | $139 |

| USAA | $726 | $121 |

The Zebra’s Dynamic Insurance Rating Tool data methodology

The Zebra’s Dynamic Insurance Rating Tool for home and auto insurance rates utilizes the latest ZIP code-level rate filings from across the U.S., sourced from Quadrant Information Services and S&P Global. These filings, typically updated annually or biennially by insurers, are verified through Quadrant’s QA process and then integrated into The Zebra’s estimator.

The displayed rates are based on a dynamic home and auto profile designed to reflect the content of the page. This profile is tailored to match specific factors such as age, location, and coverage level, which are adjusted based on the page content to show how these variables can impact premiums.

For a comprehensive understanding, see our detailed methodology.

"Weighing out your options will set you up for success. Don't just go with the lowest form of insurance because its cheap to get started. Discuss a 4-pay plan with your agent: some companies offer a plan consisting of a down payment and four payments, negating the need for a payment the last month of your policy. This option gives policyholders a break and allows people to prepare for renewals. Use this opportunity to shop around, now with a previous insurance discount."

Summer Popovich — Licensed customer service advisor at The Zebra

The Zebra's resources for drivers with poor credit

While credit is a major rating factor in most states, there are definitely ways to find affordable car insurance coverage. The Zebra has compiled resources with information on car insurance with bad credit or no credit history, including car insurance company rates.

Recommended coverage for low-income drivers

A liability-only policy is the cheapest policy you can get as a low-income driver. Keep in mind, however, that while minimum coverage will satisfy legal requirements, it provides little protection in the event of an accident. A minimum coverage policy only covers bodily injury and property damage liability — limits for these depend on which state you live and drive in.

Most insurance professionals suggest liability limits of at least 50/100/50 in order to be well protected. In most cases, these limits are much higher than what states require.

- Bodily injury per person ($50,000): This is the maximum amount your policy will pay if you injure someone in an accident.

- Bodily injury per accident ($100,000): This is the maximum amount your insurance will pay out for all of those harmed by you in the same accident.

- Property damage ($50,000): This is the total amount paid out for physical damage to property you cause in an accident.

Regardless of state limits, liability only insurance will not cover much if you get into an accident— the cost of repairs will likely have to come out-of-pocket, and a totaled car will not get you anything at all from the insurance company. That being said, if your ultimate priority is a low monthly premium, a minimum coverage policy is available from all insurance companies.

Do I have to get full coverage?

Adding comprehensive and collision coverages to cover damage to your own vehicle can seriously increase the cost of your policy. If you're thinking about forgoing these coverage types, ask yourself the following questions:

- Would most out-of-pocket repairs be too expensive?

- Do you rely on your car for work or other needs?

- Is your car worth more than $4,000?

If you answered yes to any of these questions, you may want to consider adding these optional collision and non-collision coverages to your policy.

| Company | Avg. 6 Mo. Premium | Avg. Monthly Premium |

|---|---|---|

| Allstate | $364 | $61 |

| Farmers | $359 | $60 |

| Progressive | $346 | $58 |

| Nationwide | $301 | $50 |

| State Farm | $291 | $49 |

| GEICO | $226 | $38 |

| USAA | $217 | $36 |

Zebra tip: Look into regional companies

Sometimes smaller, more localized insurance companies offer competitive rates for the same amount of coverage provided by major companies. Regional companies often offer other insurance products and discounts, so many of the standard options you're used to with major insurance providers are still available.

Other ways to find auto insurance with a lower income

Insurance companies can’t legally use your income to determine your rate, but they may use other metrics that are often — but not always — correlated to your income level. Car insurance data suggests that people with higher incomes file fewer claims, but that could be because they simply are able to pay for damages out of pocket rather than filing a claim.

Because these factors are not necessarily within your control, here are some actionable ways to save on car insurance.

Pay for claims out of pocket

Use your car insurance only if the value of damage in an accident exceeds your reasonable ability to pay for it. We understand that this option might not be realistic for someone of limited means, but it's worth exploring whether you'd prefer one hefty bill versus a higher monthly premium for many years. Unless you have some form of accident forgiveness in your car insurance policy, your company will raise your rate for three to five years after an at-fault incident. See below how much this would impact your rate.

| At-Fault Accident Surcharge | Annual Premium | Monthly Premium |

|---|---|---|

| No Violation | $1,483 | $124 |

| After Violation | $2,153 | $179 |

| 2nd Year after Charge | $2,823 | $235 |

| 3rd Year after Charge | $3,493 | $291 |

Over the course of three years, this claim could cost you over $2,000 in surcharges. Adding in a $500 deductible, your total amount paid for an at-fault accident is over $2,500. If you have an accident and the out-of-pocket costs are less than $2,500, it makes more financial sense to pay for the damages yourself. Below is a helpful guideline to do so.

- Get a cost estimate for the repairs.

- Use The Zebra's State of Insurance study to see how much an at-fault accident raised rates in your state, and consider that value over the course of three years.

- Compare the value of the out-of-pocket repairs to the rate increase over three years plus your deductible. If it's cheaper to file a claim, go for it.

Consider usage-based insurance companies

Usage-based auto insurance policies are designed to create your premium based on how you drive rather than who you are. In theory, if you're a safe driver, you can save. Below are some estimates from popular insurance companies. While not available in every state, these insurtech companies might offer some savings on telematics programs.

| Telematics Program | Estimated Savings |

|---|---|

| Progressive Snapshot | Average of $130 |

| Allstate Drivewise | Average of 10-25% |

| State Farm Drive Safe & Save | Up to 15% |

| Esurance DriveSense | Varies |

| Nationwide SmartRide | Up to 40% |

| Liberty Mutual RightTrack | Average of 5-30% |

| GEICO DriveEasy | Varies |

Be conservative with your coverage

If your vehicle is worth less than $4,000, you should consider dropping collision and comprehensive coverage from your insurance policy. These coverages are designed to protect the physical integrity of your vehicle. But if the vehicle isn’t worth much to begin with, you might be paying for coverage you do not need.

If you do decide to drop comprehensive and collision, consider if underinsured or uninsured motorist property damage is right for you. This will protect your vehicle if it’s damaged by another driver with any insurance or not enough to repair or replace it. Bear in mind, you still have to keep your state’s liability coverage by law.

Avoid letting your coverage lapse

Even small gaps in your insurance history can increase your rates when trying to find a new policy. Our data shows that 33% of Zebra customers are uninsured at the time of application. If you are going to be without a vehicle temporarily, consider purchasing a non-owners policy to keep continuous coverage. That way, when you are ready to get insurance again, your rates will be more reasonable.

Double-check for discounts

Although some of the following discounts are automatically added, you will still want to comb through your insurance policy to ensure you’re getting the best auto insurance rates. Here are some of the most common car insurance discounts:

This discount refers to having two types of insurance policies under one insurance company. This is often known as bundling. Common policies are home/auto or renters/auto. The discounts affect both your policies, typically.

If you’ve taken a defensive driving course, your insurance company may reward you with a discount on your premium. Learn more about what the big companies will offer you for your good driving record.

If your vehicle comes with an anti-theft device or services like LoJack, your insurance company usually provides a discount.

This discount is typically added automatically to your policy and tends to be beneficial. Just like its name implies, this discount refers to having a safe driving record.

A multi-car discount refers to having more than one vehicle on the same insurance policy. This can often lead to savings. While it may vary by provider, the limit of vehicles on the same policy is typically four.

This method refers to the manner you choose to pay your insurance premiums. While it varies by company, you can usually receive a discount if you pay your premium upfront, pay through your bank account or opt for paperless billing.

If you pay your insurer your premium ahead of its policy inception date, a lot of companies will give you a discount on your premium.

Statistically, some occupations like teachers, physicians or police officers are less likely to file a claim. Additionally, many companies like GEICO and Nationwide offer discounts to certain groups or organizations. Because of this, some insurers return the savings back to you.

For more information, see our guide to insurance affinity discounts.

Most companies will require the student on your policy to have a GPA above 3.0 in order to receive this discount. You can provide the insurance companies with a transcript or report card for each policy period as proof.

For more information, see our guide to student insurance discounts.

It might be a fairly obvious suggestion, but if you're already struggling to pay for car insurance you really need to take care while driving. A poor driving record is a major red flag to any insurance company. Depending on your violation type, you could end up paying surcharges on your premiums for between three and ten years.

Compare companies and find the best policy for your budget.

How personal factors might impact your auto insurance rates

There are a few things insurance companies use to set insurance rates that could be indirectly tied to a driver's income. Bear in mind that each insurance company may weigh these factors differently. Plus, some states do not allow certain factors to be used in the underwriting process.

Zebra tip: Be careful with non-standard carriers

If you are looking for rock-bottom car insurance prices, it's likely that you'll encounter non-standard carriers. A non-standard car insurance company focuses on customers who typically have a high number of accidents or otherwise struggle to find a policy. While coverage may be cheaper, you aren't likely to have as many coverage options and customer service may be lacking. Bottom line: do your research to avoid companies with poor customer service ratings.

Low income car insurance: FAQs

Below you'll find answers to some of the most common questions regarding auto insurance for low-income drivers.

Stay in touch and subscribe!

Get advice, insights and tips from our newsletter.

Related Content

- Car Insurance with No Insurance History

- Car Insurance for Drivers with Bad Credit

- How Does Bankruptcy Affect Car Insurance Rates?

- How Do Medical Conditions Affect Car Insurance Rates?

- Car Insurance for Drivers with Disabilities

- High-Risk Car Insurance

- Car Insurance for Foreign Drivers in the U.S.

- Car Insurance with No Credit History

- Gender-Neutral Car Insurance

- How Does a GED Affect Car Insurance Rates?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.