For How Long Does a Ticket Impact Your Car Insurance?

Your insurance rates could rise for three years after you receive a citation.

For how long does a speeding ticket stay on your car insurance record?

While it varies by your state, car insurance company, and severity of your ticket, you should expect a speeding citation to impact your rates for at least three years. In 2019, the average premium increase after a speeding ticket was $1,380 over three years. Let’s break this down by car insurance company and the type of speeding ticket.

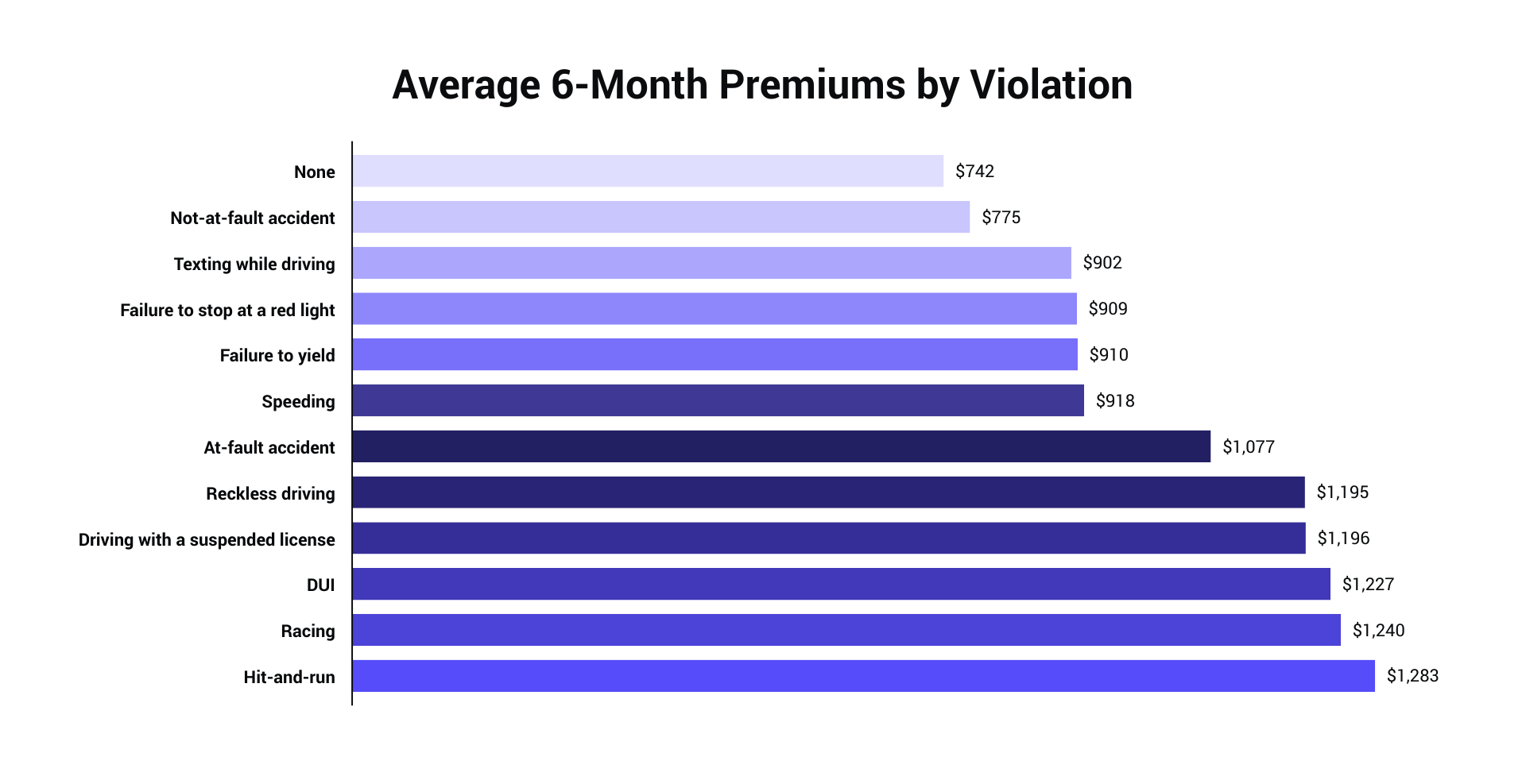

Average insurance premium increase: by citation or violation type

The duration for which your car insurance rates will be impacted by a ticket depends on your location, your insurer, and the severity of your violation. Below are average rates following a ticket or violation.

We pulled rates from top car insurance companies across the US and assessed rates after five levels of speeding ticket severity (methodology here).

- Speeding (6-10 MPH > limit)

- Speeding (11-15 MPH > limit)

- Speeding (16-20 MPH > limit)

- Speeding (21-25 MPH > limit)

- Speeding in a school zone

Speeding: 6-10 MPH > speed limit

If you’re ticketed for speeding 6 to 10 miles over the limit, expect your auto insurance rates to increase by $320 the first year. Have a look at how the additional premium accrues over the course of three years in the table below.

| Insurance company | Average premium — no ticket | Year 1 | Year 2 | Year 3 |

|---|---|---|---|---|

| Allstate | $1,888 | $2,250 | $2,612 | $2,983 |

| Farmers | $1,525 | $1,932 | $2,339 | $2,746 |

| GEICO | $1,276 | $1,515 | $1,755 | $1,994 |

| Liberty Mutual | $1,647 | $1,994 | $2,341 | $2,688 |

| Nationwide | $1,347 | $1,721 | $2,095 | $2,470 |

| Progressive | $1,604 | $2,062 | $2,520 | $2,978 |

| State Farm | $1,313 | $1,469 | $1,624 | $1,779 |

| USAA | $948 | $1,096 | $1,244 | $1,392 |

If you’re a USAA customer, you will see the smallest rate increase after such an infraction. However, this does not mean your premium will be the cheapest before a ticket.

Speeding: 11-15 MPH > speed limit

The insurance cost difference between a ticket for speeding 6 to 10 miles per hour versus 11 to 15 miles per hour over the limit is minimal — and with Farmers, Liberty Mutual, Nationwide and USAA, there is no distinction. Again, have a look at the table below to see how these additional charges can add up over a three year period.

| Insurance company | Average premium — no ticket | Year 1 | Year 2 | Year 3 |

|---|---|---|---|---|

| Allstate | $1,888 | $2,280 | $2,673 | $3,065 |

| Farmers | $1,525 | $1,932 | $2,339 | $2,746 |

| GEICO | $1,276 | $1,516 | $1,757 | $1,998 |

| Liberty Mutual | $1,647 | $1,994 | $2,341 | $2,688 |

| Nationwide | $1,347 | $1,728 | $2,108 | $2,489 |

| Progressive | $1,604 | $2,067 | $2,530 | $2,993 |

| State Farm | $1,313 | $1,476 | $1,638 | $1,800 |

| USAA | $948 | $1,096 | $1,244 | $1,392 |

Speeding: 16-20 MPH > over limit

There’s a $385 annual premium increase attached to a ticket for breaking the speed limit by 16 to 20 miles per hour. USAA again offers the smallest premium increase and both Nationwide and USAA make no premium distinction between speeding tickets for going 16-20 or 11-15 miles per hour over the limit.

| Insurance company | Average premium — no ticket | Year 1 | Year 2 | Year 3 |

|---|---|---|---|---|

| Allstate | $1,888 | $2,322 | $2,755 | $3,189 |

| Farmers | $1,525 | $1,952 | $2,378 | $2,804 |

| GEICO | $1,276 | $1,580 | $1,884 | $2,187 |

| Liberty Mutual | $1,647 | $2,014 | $2,380 | $2,747 |

| Nationwide | $1,347 | $1,728 | $2,108 | $2,489 |

| Progressive | $1,604 | $2,072 | $2,541 | $3,010 |

| State Farm | $1,313 | $1,490 | $1,667 | $1,844 |

| USAA | $948 | $1,096 | $1,244 | $1,392 |

Speeding 21-25 miles over limit

A speeding ticket in this range will increase your premium $460 per year, or about $1,380 compounded over a three-year rating period. With most insurers surveyed, the premium surcharge remained the same as the previous tier of speeding ticket (16-20 miles per hour over the limit) — with GEICO and Liberty Mutual being the exceptions.

| Insurance company | Average premium — no ticket | Year 1 | Year 2 | Year 3 |

|---|---|---|---|---|

| Allstate | $1,888 | $2,322 | $2,755 | $3,189 |

| Farmers | $1,525 | $1,952 | $2,378 | $2,804 |

| GEICO | $1,276 | $1,843 | $2,410 | $2,977 |

| Liberty Mutual | $1,647 | $2,134 | $2,622 | $3,109 |

| Nationwide | $1,347 | $1,728 | $2,108 | $2,489 |

| Progressive | $1,604 | $2,072 | $2,541 | $3,010 |

| State Farm | $1,313 | $1,490 | $1,667 | $1,844 |

| USAA | $948 | $1,096 | $1,244 | $1,392 |

| Insurance company | Average premium — no ticket | Year 1 | Year 2 | Year 3 |

|---|---|---|---|---|

| Allstate | $1,888 | $2,250 | $2,612 | $2,973 |

| Farmers | $1,525 | $2,036 | $2,547 | $3,058 |

| GEICO | $1,276 | $1,542 | $1,809 | $2,075 |

| Liberty Mutual | $1,647 | $1,994 | $2,341 | $2,688 |

| Nationwide | $1,347 | $1,721 | $2,095 | $2,470 |

| Progressive | $1,604 | $2,067 | $2,531 | $2,994 |

| State Farm | $1,313 | $1,474 | $1,635 | $1,796 |

| USAA | $948 | $1,096 | $1,244 | $1,392 |

Does a ticket in a different state impact your insurance policy?

Most states participate in the Driver's License Compact — or DLC — in which they share violation information between a driver’s home state and the state in which a violation occurred. Because not all states participate or share information, the impact of an out of state ticket may vary, depending on where you receive your traffic ticket.

Massachusetts, Michigan, Tennessee and Georgia are not members. Other states, such as Colorado, Maryland, Nevada, New York and Pennsylvania, will only share information for major convictions, such as a DUI or reckless driving charge.

In short, the impact will depend on both states and the nature of the traffic violation.

How can I save on car insurance after a ticket?

Let’s outline some quick fixes to help keep your premium low.

Be smart with your claims

Most insurance experts advise you to only use your car insurance coverage if the value of damage exceeds your reasonable ability to pay for it. This is because most insurance companies will substantially raise your rates after you file a claim. On average, an at-fault collision claim raised rates an average of $767 per year. Like a ticket, you should expect an at-fault accident to impact your rates for three to five years.

If you’re unsure of whether or not to file a claim, see our guide:

- Get an estimate for the repairs at a local auto body repair shop.

- Use our State of Insurance report to see how much an at-fault accident would impact rates in your state.

- Compare the out-of-pocket expense to the rate increase (plus your deductible). If it is cheaper to file a claim, do that.

Learn more about when to file a car insurance claim.

Pay only for the coverage you need

If your owned vehicle is worth less than $4,000, you typically do not need comprehensive or collision coverage. These coverages are not required by law and only act to protect the physical value of your vehicle. If your vehicle is not worth much, you could be paying for more insurance than you need.

You can determine the value of your vehicle from Kelley Blue Book or NADA online. If you remove comprehensive and collision coverage, consider adding uninsured motorist coverage, which will help protect you from uninsured drivers. Keep in mind, however, that the out-of-pocket cost of repairs could far outweigh the cost of comprehensive and collision coverage in some cases.

Double-check for discounts

Discounts are not going to be a big money saver in terms of car insurance, and you should not stay with your current insurer simply because they offer you a discount. However, perks like a good driver discount or lower rates offered after taking a defensive driving course can be helpful in saving a few bucks. Below are some common discounts you should see if your insurance provider offers. Learn more about popular car insurance discounts.

Aside from successfully contesting a ticket, your best bet for avoiding higher rates and saving money is to shop around for auto insurance quotes. The auto insurance company you're covered by is a key factor in how much you pay after a ticket.

Enter your ZIP code below to see how much you could be paying, given your driving record.

Compare quotes from over 100 providers.

Related content

- Can You Get Car Insurance with a Suspended License?

- Cheap Car Insurance After a DUI

- How Do Points on Your License Affect Car Insurance?

- What's the difference between DUI and DWI?

- Does a Felony Affect Your Car Insurance?

- Car Insurance with Expired Registration

- Will a MIP Violation Affect Car Insurance Rates?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.