If you're seeking flexible car insurance, you might be interested in a short-term car insurance policy. But short-term car insurance agreements are uncommon for a few reasons.

Most major insurers will not offer policies for less than six months. As car coverage is mandated by law in most places in the US, swapping policies by the month can be risky. Additionally, you risk having gaps in your car insurance history if you swap policies often, leading to higher prices in the long run.

Fortunately, auto insurance contracts commonly run for just half of a year. This short duration allows insurers to frequently “re-rate” — or recalculate — your policy with your up-to-date driving profile and personal info.

It also gives you a timely opportunity for you to improve your situation by shopping for a policy with other insurers. Comparing quotes online costs nothing, and there is no penalty for swapping car insurance companies at the start of a new policy — or even in the middle of your policy period, as long as your insurance doesn't lapse.

The short-term nature of auto insurance makes it relatively easy to acquire on short notice. If you require a policy to take a new vehicle off the lot, trying to find insurance for a relatively long-term car rental or searching for coverage for a car you don't own but drive often, think about purchasing a policy and cutting the term short as needed.

Find affordable short-term car insurance today.

Temporary insurance in New York

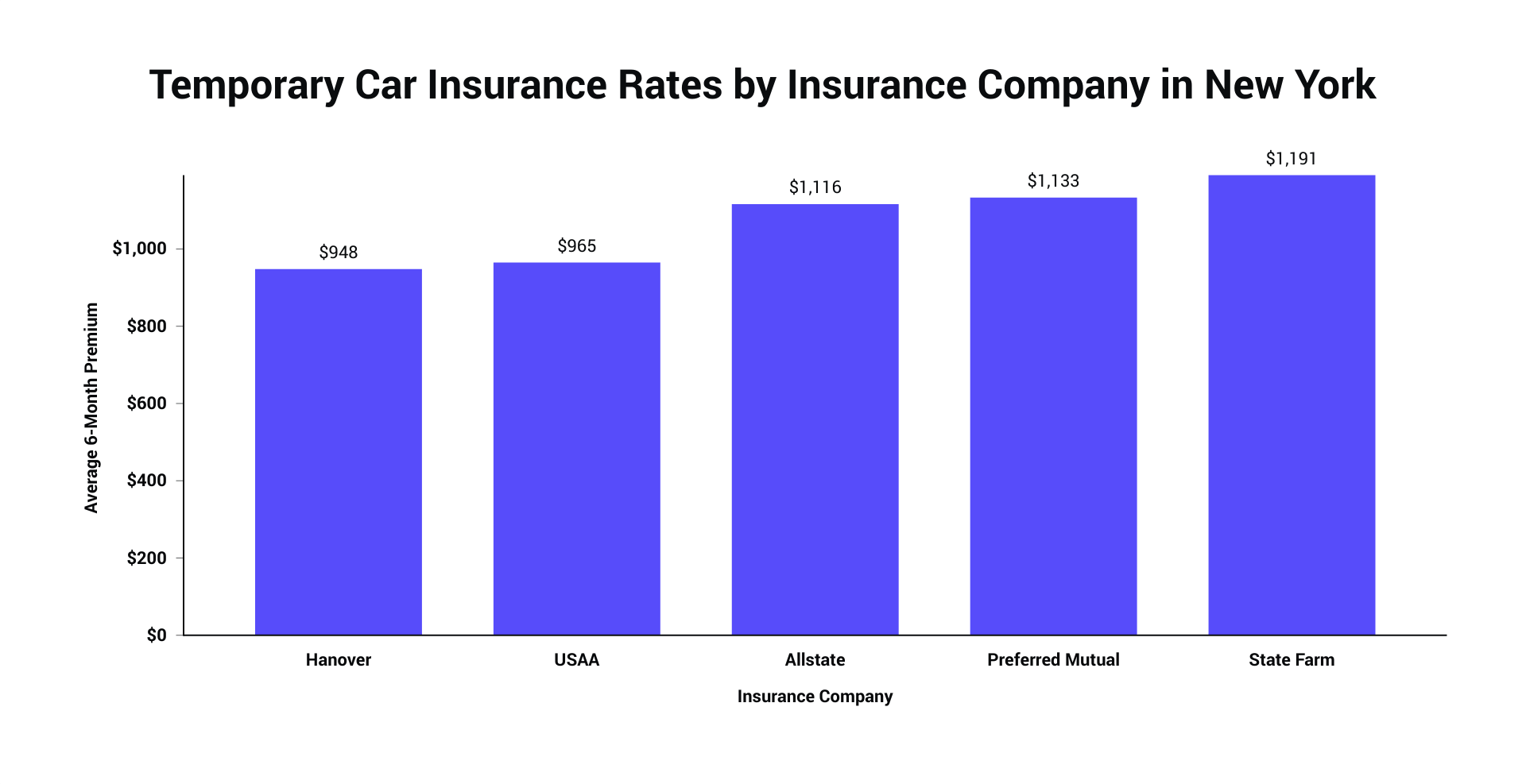

See below typical auto insurance prices in New York, organized by major insurers and the most populous cities. If your costs exceed the rates below, think about shopping around.

TEMPORARY AUTO INSURANCE RATES IN NEW YORK — BY COMPANY

| Insurance Company | Average 6-Month Rate | Average Monthly Rate |

|---|---|---|

| New York State Average — All Companies | $852 | $142 |

| Hanover | $948 | $158 |

| USAA | $965 | $161 |

| Allstate | $1,116 | $186 |

| Preferred Mutual | $1,133 | $189 |

| State Farm | $1,191 | $198 |

The most budget-friendly option for single-month car insurance in New York is Hanover, which can save you $3 per month, compared to the next-best choice, USAA. In New York, the average monthly price of auto insurance is $142, or $852 over a six-month term.

Where you drive can have as great an impact on your insurance rates as the insurance company you choose. Car insurers weigh the frequency of claims in a given area when drafting prices by ZIP. See below insurance premiums in New York State's most populous cities and compare against what you’re paying.

TEMPORARY AUTO INSURANCE RATES IN NEW YORK — BY CITY

| Location | Average 6-Month Rate | Average Monthly Rate |

| New York City | $1,502 | $250 |

| Buffalo | $850 | $142 |

| Rochester | $648 | $108 |

| Yonkers | $1,186 | $189 |

| Syracuse | $709 | $118 |

Because so many factors are involved in setting insurance rates, your quotes may not match those displayed above. If your current premiums don't match those listed above, consider taking a moment to compare quotes. The temporary duration of a car insurance policy enhances the importance of staying informed and willing to shop.

Find out more about temporary auto insurance or use The Zebra to compare quotes today.

Related content

- Check out the best auto insurance options for teen drivers.

- Get affordable car insurance for new drivers.

- Find out more about pleasure use car insurance.

- Can you find affordable car insurance with no credit history?

About The Zebra

The Zebra is not an insurance company. We publish data-backed, expert-reviewed resources to help consumers make more informed insurance decisions.

- The Zebra’s insurance content is written and reviewed for accuracy by licensed insurance agents.

- The Zebra’s insurance editorial content is not subject to review or alteration by insurance companies or partners.

- The Zebra’s editorial team operates independently of the company’s partnerships and commercialization interests, publishing unbiased information for consumer benefit.

- The auto insurance rates published on The Zebra’s pages are based on a comprehensive analysis of car insurance pricing data, evaluating more than 83 million insurance rates from across the United States.